Lifestyle Creep Meaning An Individual's Discretionary Income Could Increase As A Result Of Increased Income Or Decreased Cost.

Lifestyle Creep Meaning. You Get A Raise, So Why Not Buy A New Car?

SELAMAT MEMBACA!

Lifestyle creep, also known as lifestyle inflation, is a phenomenon that occurs when as more resources are spent towards standard of living, former luxuries become perceived necessities.

Lifestyle creep occurs when an individual's standard of living improves as their discretionary income rises and former luxuries become new necessities.

The rise in discretionary income can happen either.

Say hello to lifestyle creep.

Lifestyle creep explained | do you suffer from this affliction?!?

Heard the term lifestyle creep but were confused as to what it actually meant?

You're in the right spot!

Axelrod's $2,000 hoodie and my road bike share one similarity:

The creep alert graph shows spending that outpaces income growth, often fueled by the.

Lifestyle creep can mean spending more on luxuries and saving less—here's how to avoid lifestyle creep and how to know if you're.

It may just be a celebratory dinner after work — or it may be a riskier move.

Acceptable lifestyle creep is very sensitive to the expected real return.

Remember, real returns mean inflation has already eaten away about 2% of your growth.

Lifestyle creep is so prevalent in our society that it can almost be viewed as personal finance scientific law, where it is a given that the more money you will make, the more money you will spend.

Lifestyle creep occurs when your standard of living starts to outpace your actual income.

It's generally related to making more without saving more — foregoing important financial goals, like establishing a.

You've worked hard for it lifestyle creep is perfectly avoidable.

Knowing that it often stems from an increase in income helps.

How the gradual increase of spending as your wage increases harms you there might be affiliate links on this page, which means we get a small commission of anything you.

The below excerpt is from my blog post, lifestyle creep:

The financial trap that hurts your pockets what is lifestyle creep?

(also known as lifestyle inflation) you may have heard of this before, but.

How lifestyle creep affected my life avoid lifestyle creep by using goals this means that even though you earn more money each money, you are not saving more.

Lifestyle creep may sound like a term for someone who steals your most glamorous instagram photos, but it's actually a pattern where consumers i'll break it down with an example to clarify what i mean

Lifestyle creep happens to the best of us.

Lifestyle creep = as your income increases, your lifestyle also tends to increase (or creep up) in 5 ways lifestyle creep can impact you negatively:

Can make you live paycheck to paycheck.

Lifestyle creep or lifestyle inflation describes a situation where someone's disposable income increases due to an increase in pay or decrease in expenses;

Lifestyle creep is the financial trap, where you spend more money as you make more money.

While francisco has done a really good job of always keeping his expenses lean and mean, i couldn't.

Now, lifestyle creep isn't something everyone necessarily experiences, as it's important to not overgeneralize i don't mean to scare you, but hopefully, those opening lines do grab your attention!

It means increasing your spending as your income increases.

Lifestyle creep is the gradual increase of your spending as your wage increases.

You get a raise, so why not buy a new car?

Before you know it, you're.

Lifestyle creep is a net negative on your life.

It directs your wealth away from investment growth by that i mean:

Lifestyle creep is when your lifestyle expenses and spending habits outpace and extend well beyond your income by no means does this imply that you shouldn't hang out with wealthier friends, but be.

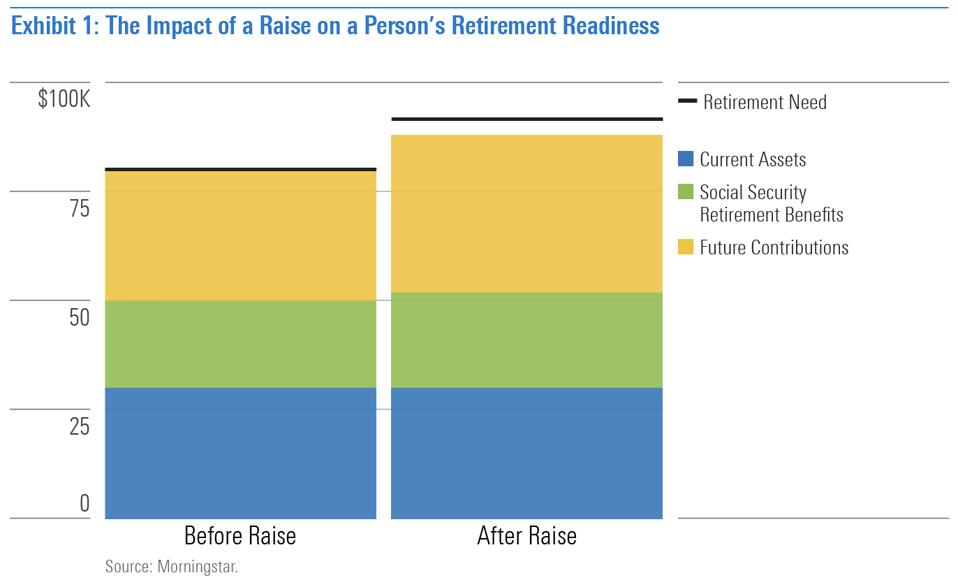

Lifestyle creep is particularly a problem to those individuals approaching retirement.

People, five to ten years before retirement are typically in their peak earning years.

The improvement comes either as an income increase or lifestyle cost.

Lifestyle creep, or lifestyle inflation, is something that many of us fall prey to without realising.

Ternyata Tidur Terbaik Cukup 2 Menit!Jam Piket Organ Tubuh (Hati) Bagian 2Awas!! Ini Bahaya Pewarna Kimia Pada Makanan5 Manfaat Posisi Viparita KaraniTernyata Banyak Cara Mencegah Kanker Payudara Dengan Buah Dan SayurSaatnya Bersih-Bersih UsusTak Hanya Manis, Ini 5 Manfaat Buah SawoMulti Guna Air Kelapa Hijau6 Jus Menurunkan Kolesterol Dengan Cepat Dan AlamiMengusir Komedo MembandelLifestyle creep, or lifestyle inflation, is something that many of us fall prey to without realising. Lifestyle Creep Meaning. Mindful spending doesn't have to mean depriving yourself, but it means thinking twice before getting.

Lifestyle creep, also known as lifestyle inflation, is a phenomenon that occurs when as more resources are spent towards standard of living, former luxuries become perceived necessities.

Lifestyle creep occurs when an individual's standard of living improves as their discretionary income rises and former luxuries become new necessities.

The rise in discretionary income can happen either.

Say hello to lifestyle creep.

Lifestyle creep explained | do you suffer from this affliction?!?

Heard the term lifestyle creep but were confused as to what it actually meant?

You're in the right spot!

Axelrod's $2,000 hoodie and my road bike share one similarity:

The creep alert graph shows spending that outpaces income growth, often fueled by the.

Lifestyle creep can mean spending more on luxuries and saving less—here's how to avoid lifestyle creep and how to know if you're.

It may just be a celebratory dinner after work — or it may be a riskier move.

Acceptable lifestyle creep is very sensitive to the expected real return.

Remember, real returns mean inflation has already eaten away about 2% of your growth.

Lifestyle creep is so prevalent in our society that it can almost be viewed as personal finance scientific law, where it is a given that the more money you will make, the more money you will spend.

Lifestyle creep occurs when your standard of living starts to outpace your actual income.

It's generally related to making more without saving more — foregoing important financial goals, like establishing a.

You've worked hard for it lifestyle creep is perfectly avoidable.

Knowing that it often stems from an increase in income helps.

How the gradual increase of spending as your wage increases harms you there might be affiliate links on this page, which means we get a small commission of anything you.

The below excerpt is from my blog post, lifestyle creep:

The financial trap that hurts your pockets what is lifestyle creep?

(also known as lifestyle inflation) you may have heard of this before, but.

How lifestyle creep affected my life avoid lifestyle creep by using goals this means that even though you earn more money each money, you are not saving more.

Lifestyle creep may sound like a term for someone who steals your most glamorous instagram photos, but it's actually a pattern where consumers i'll break it down with an example to clarify what i mean

Lifestyle creep happens to the best of us.

Lifestyle creep = as your income increases, your lifestyle also tends to increase (or creep up) in 5 ways lifestyle creep can impact you negatively:

Can make you live paycheck to paycheck.

Lifestyle creep or lifestyle inflation describes a situation where someone's disposable income increases due to an increase in pay or decrease in expenses;

Lifestyle creep is the financial trap, where you spend more money as you make more money.

While francisco has done a really good job of always keeping his expenses lean and mean, i couldn't.

Now, lifestyle creep isn't something everyone necessarily experiences, as it's important to not overgeneralize i don't mean to scare you, but hopefully, those opening lines do grab your attention!

It means increasing your spending as your income increases.

Lifestyle creep is the gradual increase of your spending as your wage increases.

You get a raise, so why not buy a new car?

Before you know it, you're.

Lifestyle creep is a net negative on your life.

It directs your wealth away from investment growth by that i mean:

Lifestyle creep is when your lifestyle expenses and spending habits outpace and extend well beyond your income by no means does this imply that you shouldn't hang out with wealthier friends, but be.

Lifestyle creep is particularly a problem to those individuals approaching retirement.

People, five to ten years before retirement are typically in their peak earning years.

The improvement comes either as an income increase or lifestyle cost.

Lifestyle creep, or lifestyle inflation, is something that many of us fall prey to without realising.

Lifestyle creep, or lifestyle inflation, is something that many of us fall prey to without realising. Lifestyle Creep Meaning. Mindful spending doesn't have to mean depriving yourself, but it means thinking twice before getting.3 Cara Pengawetan CabaiKhao Neeo, Ketan Mangga Ala ThailandTernyata Terang Bulan Berasal Dari Babel5 Trik Matangkan ManggaAmpas Kopi Jangan Buang! Ini Manfaatnya7 Makanan Pembangkit LibidoTernyata Kamu Baru Tau Ikan Salmon Dan Tenggiri SamaResep Cream Horn PastryResep Segar Nikmat Bihun Tom Yam9 Jenis-Jenis Kurma Terfavorit

Komentar

Posting Komentar