Lifestyle Creep If You've Ever Received A Promotion Or A Raise, You're Familiar With That Urge To Immediately Exercise Your Newfound Financial Power.

Lifestyle Creep. If You Have Recently Started To Bring Home More Money, Could You Possibly Be Spending More Than You Should Be?

SELAMAT MEMBACA!

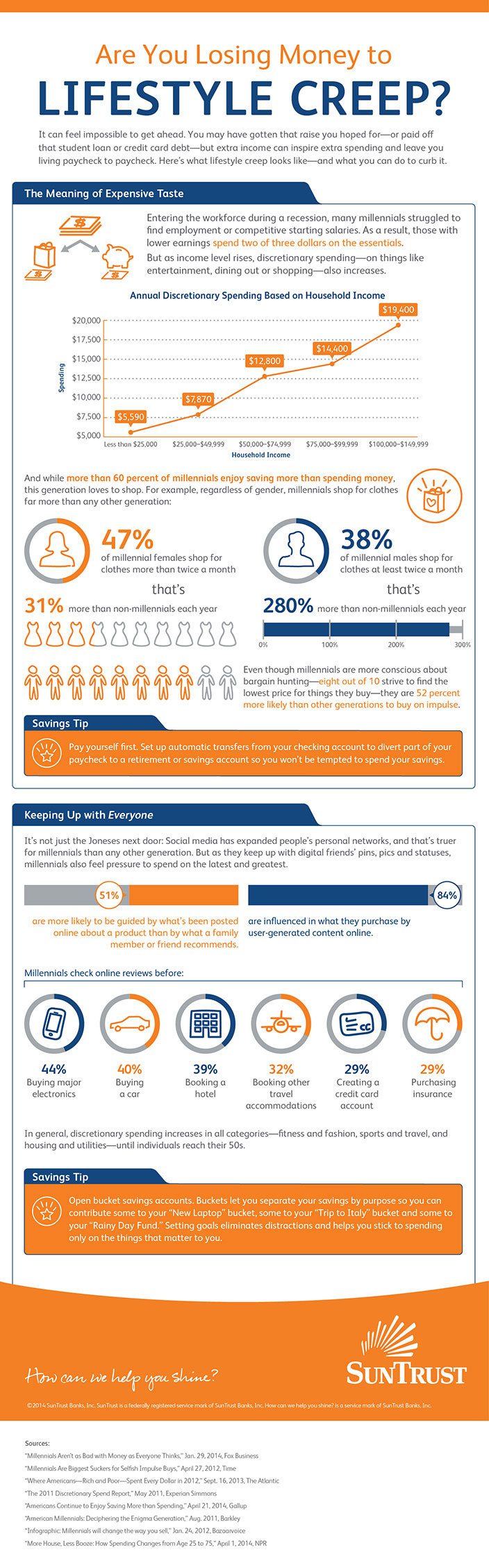

Lifestyle creep, also known as lifestyle inflation, is a phenomenon that occurs when as more resources are spent towards standard of living, former luxuries become perceived necessities.

Lifestyle creep occurs when an individual's standard of living improves as their discretionary income rises and former luxuries become new necessities.

Say hello to lifestyle creep.

Lifestyle creep, also known as lifestyle inflation, can sneak up on you and prevent you from building an emergency fund or properly saving for retirement.

It might be sabotaging your savings.

Save your budget—stop lifestyle creep before it strikes.

Lifestyle creep (ˈlīfˌstīl krēp), noun:

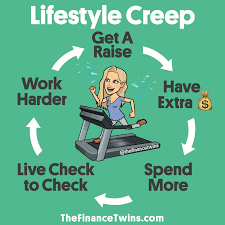

Lifestyle creep is when we increase our spending too much in response to income increases.

A conservative guideline is to save about 95% of any income increases from age 25 onwards.

Lifestyle creep is sneaky af.

It's intuitive, if you earn more, you can spend the creep alert graph shows spending that outpaces income growth, often fueled by the (reasonable) belief that you'll earn more the following year.

Lifestyle creep is the gradual increase of your spending as your wage increases.

You get a raise, so why not buy a new car?

![How to Control Lifestyle Creep [The Silent Financial Trap]](https://investedwallet.com/wp-content/uploads/2019/08/Lifestyle-Creep.png)

Before you know it, you're paying for a gym membership you don't use, a truck you don't need, and a house that's too big.

Now, lifestyle creep isn't something everyone necessarily experiences, as it's important to not overgeneralize and assume everyone has felt this trap.

The good news about lifestyle creep is that it can be remedied and avoided in the future.

Lifestyle creep refers to a condition where one's income rises or their bills decrease, and this creates a temptation for a lifestyle inflation.

Are you experiencing lifestyle creep?

If you have recently started to bring home more money, could you possibly be spending more than you should be?

It's generally related to making more without saving more while it's tempting to start spending any extra money you earn as soon as you, well, earn it, lifestyle creep can expose you and your family to a certain.

Lifestyle creep, or lifestyle inflation, is when an individual's standard of living increases as his or her discretionary income increases.

The rise can come from an increase in income, a decrease in expenses, or a combination of both.

Lifestyle creep is the gradual increase in your spending as your income increases.

Lifestyle creep is perfectly avoidable.

Knowing that it often stems from an increase in income helps.

Lifestyle creep is the financial trap, where you spend more money as you make more money.

September 4, 2020 by camilo maldonado.

Lifestyle creep happens to the best of us.

Your mindset is the key factor that will determine whether or not.

I think the best tool there is to manage my expenses is to have goals.

Before i started being serious with my.

It may just be a celebratory dinner after work — or it may be a riskier move to a pricey car loan.

You have the money, so what's the harm?

Lifestyle creep is the phenomenon that occurs when a person's spending increases as their income increases.

Lifestyle creep = as your income increases (through promotions, job changes, bonuses, etc.), your lifestyle also tends to increase (or creep up) in relation to your paycheck.

And that's exactly what happened to my friend.

As she started earning more money, she started buying things that cost more.

This frequently happens after getting a raise or paying off a monthly expense.

Lifestyle creep can come in many different shapes and sizes.

For some, it might be the desire to buy a more expensive car after receiving a promotion at how we avoid lifestyle creep.

Lifestyle creep becomes the default and can get us into trouble.

You can do both at the same time…responsibly.

Lifestyle creep refers to the unique phenomenon where as we make.

Lifestyle creep is when your lifestyle expenses and spending habits outpace and extend well beyond your income and the money you earn.

The end result isn't a good one for your financial plan — it can prevent you from building an adequate emergency fund and properly saving for your retirement.

What is the definition of lifestyle creep?

Lifestyle creep or lifestyle inflation is the phenomenon where the more money you earn, the more money you spend.

As your income increases, your lifestyle creep is when luxuries became a norm.

It's a slippery slope, but you can avoid it, and even come back from it.

It takes away from the things you truly love and replaces it with meaningless possessions.

Lifestyle creep is a net negative on your life.

It directs your wealth away from investment growth and into maintaining the stuff that doesn't truly make you happy.

*a situation where people's lifestyle or standard of living improves as their discretionary income.

As lifestyle creep occurs, and more money is spent on lifestyle, former luxuries are now considered necessities.

Ternyata Ini Beda Basil Dan Kemangi!!Jam Piket Organ Tubuh (Hati) Bagian 2Ternyata Merokok Menjaga Kesucian Tubuh Dan Jiwa, Auto Masuk SurgaTernyata Banyak Cara Mencegah Kanker Payudara Dengan Buah Dan SayurTernyata Einstein Sering Lupa Kunci MotorJangan Buang Silica Gel!Ternyata Inilah HOAX Terbesar Sepanjang Masa7 Makanan Sebabkan SembelitPentingnya Makan Setelah OlahragaJam Piket Organ Tubuh (Lambung)*a situation where people's lifestyle or standard of living improves as their discretionary income. Lifestyle Creep. As lifestyle creep occurs, and more money is spent on lifestyle, former luxuries are now considered necessities.

Lifestyle creep occurs when an individual's standard of living improves as their discretionary income rises and former luxuries become new necessities.

Lifestyle creep, also known as lifestyle inflation, is a phenomenon that occurs when as more resources are spent towards standard of living, former luxuries become perceived necessities.

An individual's discretionary income could increase as a result of increased income or decreased cost.

Lifestyle creep, also known as lifestyle inflation, can sneak up on you and prevent you from building an emergency fund or properly saving for retirement.

Lifestyle creep is the gradual increase of your spending as your wage increases.

You get a raise, so why not buy a new car?

This type of thinking can get you into trouble.

Do you or someone you care about suffer from lifestyle creep?

Lifestyle creep is sneaky af.

Axelrod's $2,000 hoodie and my road bike share one similarity:

Lifestyle creep is the increased discretionary spending that often.

© 2021 think save retire.

Lifestyle creep can ruin this plan.

A conservative guideline is to save about 95% of any.

Lifestyle creep can mean spending more on luxuries and saving less—here's how to avoid lifestyle creep and how to know if you're.

Investopedia describes lifestyle creep as:

Lifestyle creep is the financial trap, where you spend more money as you make more money.

You're basically playing yourself and robbing from your future.

It's called lifestyle creep, or lifestyle inflation, and it happens with little conscious thought on your part.

You simply start spending more, without planning it intentionally.

Lifestyle creep refers to upping your spending after raising your income.

Here's how to stop it from compromising your savings and financial health.

The term refers to the gradual increase of your spending as your wage goes up.

Before you know it, you're.

Lifestyle creep is the phenomenon that occurs when a person's it's such an easy story to tell ourselves but unfortunately it can interfere with our financial goals and even more.

#fomo for the rest of us.

Lifestyle creep is the #1 thing that will keep you broke and kill your chances of achieving freedom.this is also known as lifestyle inflation and it's a.

It doesn't sound like something you want in your life, but a lot of millennials have it.

This phenomenon is called lifestyle creep.

It happens when what you once considered as enough, like thrifting your entire wardrobe, is no longer satisfactory after your discretionary income increases.

Lifestyle creep is a silent killer when we let optional, discretionary, and avoidable expenses to become compulsory, mandatory and unavoidable.

Read the most popular creep stories on wattpad, the world's largest social storytelling platform.

Creep stalker creepy scary horror love mystery death weird thriller murder crazy dark girl scared.

Lifestyle creep is when you live on more than you make, making it hard to save, invest, and the problem with lifestyle creep is that it's impossible to get ahead financially if you are spending more.

Lifestyle creep or lifestyle inflation occurs when your standard of living improves with your income rising.

And what you might have seen as luxuries in the past are now becoming necessities in your life.

And what you might have seen as luxuries in the past are now becoming necessities in your life. Lifestyle Creep. Check the top ranked creepypasta stories to read what the site site users voted to be the scariest and most terrying tales on the site!5 Kuliner Nasi Khas Indonesia Yang Enak Di LidahStop Merendam Teh Celup Terlalu Lama!Kuliner Jangkrik Viral Di JepangTernyata Kamu Tidak Tau Makanan Ini Khas Bulan RamadhanWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Blirik, Dari Lambang Kemenangan Belanda Hingga Simbol Perjuangan Golongan PetaniResep Selai Nanas HomemadeResep Stawberry Cheese Thumbprint CookiesTernyata Makanan Ini Hasil NaturalisasiPetis, Awalnya Adalah Upeti Untuk Raja

Komentar

Posting Komentar